With a strong FY-19, we entered the next Fiscal with high hopes and expectations. But, where did we end it? 45 of the 50 Nifty Companies ended the year in Red. The Index itself shed 26% during the year, while the BSE Sensex shed 24% during the fiscal.

Starting the year on a High, the Markets were a bit uncertain throughout the year over fears of a looming recession over the country subject to muted growth and the NBFC Crisis triggered by the Bankruptcy Filing of IL&FS. A number of Fiscal Stimuli and Rate cuts helped accelerate growth and demand

Just as India Inc. was looking to recover from this slowdown and projected better growth prospects for FY 20-21, Novel Coronavirus fears shattered the Markets, breaching every Support line and Wiping out gains of the last 3 years! All in less than 3 Months!

Additionally, The Rupee’s performance during the year wasn’t anything to be proud of as well, because the intensive selling by FII’s has led the Dollar to scale new highs during the year, among a host of other reasons. Below is the performance of USD-INR for the last 12 months.

Talking about Numbers, the BSE Sensex opened the year at around 38,800 before breaching the 37,000 level a month later. The Fluctuations continued wherein the BSE Sensex touched the 40,000 mark in July just before it plummet to 36,500 levels in September over the economic slowdown and growing fears of a recession staring us right in the face. It then proceeded to touch record highs of over 42,000 points in January. Well, we all know what happened after that!

Once COVID – 19 started spreading globally, Markets all over the world witnessed selling pressure like never seen before. It seemed as if all economic activity had come to a standstill. Both, the Indian and Global Markets were subjected to Trading Halts due to Indices hitting Lower Circuits frequently, with the Dow Jones Industrial Average (DJIA) hitting the lower circuits 4 times in two weeks, with the fall smashing record day after day (referred to as Black Monday and Black Thursday), falling by more than 3,000 points on several of these occasions. The BSE Sensex tumbled from its All time High of 42,273.87 to a 52-Week Low of 25,638.90 on 24th March 2020, over fears of the Pandemic.

The Sensex now trades at levels last experienced in May 2017, presenting a great opportunity to scoop up stocks at such low Valuations. Both the Indices lost 29% each during the 4th Quarter of FY 19-20 (Jan – March, 2020). The Fall in the Market Capitalisation is equal to 40% of India’s GDP and is surprisingly 7 times the Fiscal deficit of India Inc.

The Nifty PE Ratio (The Total Market Capitalisation of all Nifty Companies divided by their Total Earnings), fell to 18.22 on 1st April, 2020, from above 28 levels in January! Whereas the BSE Sensex trades at 16.99 times as compared to 26.43 a year ago.

What does this indicate?

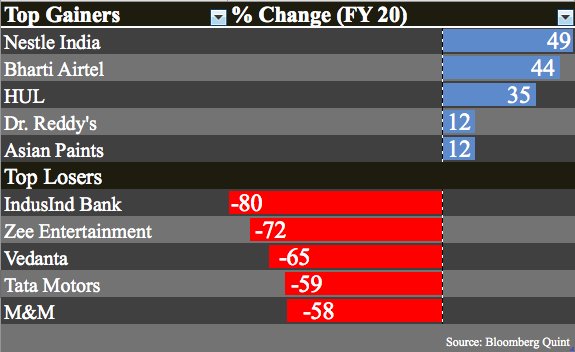

This huge fall in the PE Ratio indicates that Nifty Companies are trading at much lower and attractive valuations, as compared to a quarter ago. The Nifty Bank Index plunged by over 40% with IndusInd and RBL Bank Leading the fall, which declined by around 80% each. The gains of all the 12 constituents of the Index has been wiped out.

This has been the worst quarterly fall since 1992. But, amidst such fear, this presents us with an opportunity! The opportunity to scoop up these stocks at a much lower valuation than what they were traded for.

But then, What lies ahead?

Although, many investors are still trying to figure out if the Market has bottomed out or will it continue experiencing the heavy Sell Off led mainly by FII’s (Foreign Institutional Investors), it is quite hard to see the end of this fall. The Rising number of cases in both, the country and globally, isn’t helping either.

According to D – Street Veteran and Morgan Stanley MD Riddham Desai, “The bottom of the current stock market crash may not be there yet. It will take time for the market to form one,” Additionally, he also said, “Some good businesses have become cheap enough for us to buy. We believe they will make a comeback much faster. We remain focused on price. Will go and buy these businesses if they are rightly priced.”

India VIX, the volatility Index based on the Nifty50 Option, did form a new all time high at 86.635 points, before falling back to 55.30, where it is currently trading, indicating that the volatility is decreasing slowly. This is a good indicator for buyers in the market as it tells us that the volatility experienced by the market is declining and hopefully.

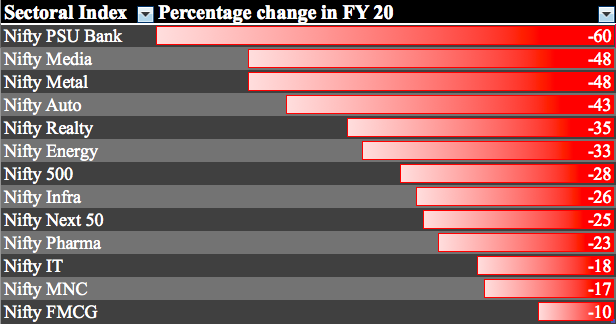

As inferred from the chart, Nifty FMCG fell the least, while PSU Banking Index was the worst hit. Stocking up of essential goods by consumers and the fact that the production of essential goods was not hampered as much as other commodities, saved the companies constituting the FMCG Index. On the other hand, Banking, Finance and NBFC (Non – Banking Financial Corporations), are the worst hit because of the fears of consumers defaulting on their Credit Card Re Payments and Unsecured Loans, in addition to companies seeing No Business at these times.

Thus, as mentioned earlier, several businesses have fallen to attractive valuations and can be invested in. But, two things will be of key interest here. The price at which the shares are trading and the fundamentals of the company. Keeping these things in mind, an investor can take a decision.

Taking a long term view, the possibility of the Index Bouncing back are high. Many companies might not be able to survive this crisis, but the ones who do, will emerge as great investments for the future. Therefore, an investor with a long term view should carefully analyse companies and their solvency. But, even at such low valuations, one should be careful not to overpay.

The Short Term performance of the Market mainly depends on the rate at which the Virus spreads and on the death rate, in addition to what further preventive measures do nations take to tackle the pandemic. At such a time, effective measures taken by India, as well as other economic powerhouses to stop the spread can act as a trigger in the right direction.

Although the idea of a vaccine still seems far fetched, Hydroxycloroquine (Used for treating Malaria), along with several other drugs, have been doing the rounds and tests are currently being carried out to determine if it can help us in the fight against the Virus, though nothing can be said as of now. Despite this, any development in this side can also boost the sentiment of Investors.

Investing all your money at once might not seem as a wise option right now because there is no immediate sign of the Virus dying down and the chances of a vaccination seem bleak, as of now. Thus, in case of a fall, averaging your position might be a good option.

All said and done, the current valuations of companies do seem attractive, but, what happens in the future is yet to be seen!

Great study

LikeLike

Great study of market

Mahavir Bahety

LikeLike